Business Department Faculty

Mr. David Faust

Team Leader

Mr. David Gish

We assist students in understanding the workings of the economy and businesses, both personal and corporate. Students will increase their understanding of their potential roles and their responsibilities as employees, employers, and leaders.

In Loving Memory of Robert Jacob Rebitski, SHDHS Class of 2016

“Greater love has no one than this: to lay down one’s life for one’s friends.” — John 15:13

This scholarship honors the memory of Robert Rebitski, a 26-year-old SHDHS graduate who was wicked smart and lived with quiet strength, selfless love, and a deep appreciation for the everyday. He found joy in the ordinary and wasn’t afraid to be a little ornery—in the best way. He had an infectious smile and giggle.

Robert brought humor, grit, and determination to everything he did—especially when it came to caring for others. He would lay down his life for his brother or sister and lived out his Catholic faith through humility, service, and devotion to family. He thought outside the box—not just in business, where he boldly purchased and ran his father’s legacy company—but also in how he loved, solved problems, and made others feel seen and valued through his quiet acts of kindness. He earned the Boy Scouts’ highest honor of Eagle Scout and stayed true to the Scout Oath.

This scholarship reminds us that while Crusaders may come from different paths, we are united in our mission to serve, lead, and love well.

Eligibility:

The Sara Meineke Memorial Scholarship

The Sara Meineke Memorial ScholarshipThe Sara Meineke Memorial Scholarship was established in memory of Sara Meineke and is to be awarded annually to a current SHDHS freshman, sophomore, or junior. As a student and athlete, Sara was a driven and determined individual. She was an excellent team player, and as a friend and family member, she always made a point to be there and support her friends and teammates. This award will be given based on a written essay submitted by the student. This essay should include examples of a student’s overall kindness and support of others, participation in extracurricular activities, and a specific time where the student demonstrated inclusivity/support to a peer, which will also be taken into consideration by the family.

Amount: $1000 towards SHDHS tuition

Eligibility: Current St. Henry District High School student (freshman, sophomore, or junior)

Availability: Annually

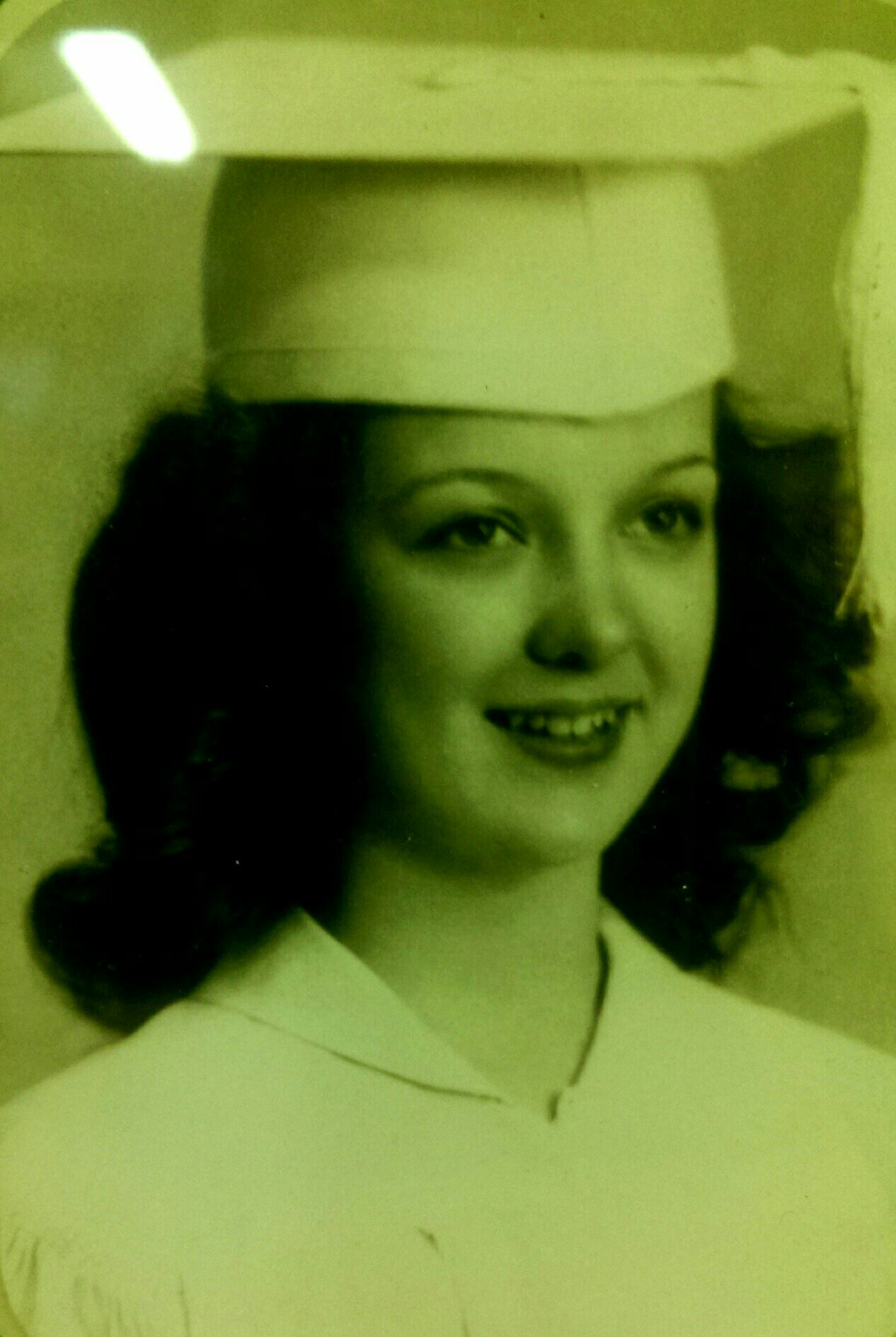

Charlotte Ruehl Flynn Memorial Scholarship

Charlotte Ruehl Flynn Memorial ScholarshipThe Charlotte Ruehl Flynn Memorial Scholarship seeks to recognize a St. Henry District High School student who exemplifies Mrs. Flynn’s deep love for, and devotion to, St. Henry, education, and their community. Based on a review of applicants, one $500 scholarship for tuition assistance will be awarded to a student in appreciation of a high school career supporting Mrs. Flynn’s values and anticipating a future embodying the same.

Amount: $500 towards SHDHS tuition

Eligibility: Incoming or Current St. Henry District High School Student who 1) attended St. Henry Grade School and 2) lives in the Erlanger / Elsmere area.

Grades: 12

Requirements: Essay

Grade: 12- A student who would like to pursue a career in education

The average awarded scholarship is $1,000

The Mary Evelyn Klingenberg Scholarship was established to honor Ms. Klingenberg’s dedication to teaching after 25 years at SHDHS. After the scholarship was established, she continued to teach for 20 more years. Ms. Klingenberg taught math for 45 years at St. Henry District High School. She is a beloved teacher who encouraged others to enjoy the joy of learning and reap the rewards of a career in education.

Essay criteria

Q. What can I contribute to teaching, and what do I expect teaching to give to me? This essay question will give the scholarship committee a deeper understanding of your passion for education and your potential impact as a future educator.

This essay question will give the scholarship committee a deeper understanding of your passion for education and your potential impact as a future educator.

When writing the essay, please do not put your name on it.

Grades: 8, 9, 10, 11

Paul and Mary Hemmer knew the importance of education, especially Catholic education. They both attended Saint Benedict Grade School in Covington where they met in the 1st grade. Both received scholarships to Catholic high schools, Paul to Saint Xavier High School and Mary to Villa Madonna Academy. Their Catholic education provided them with a strong foundation that helped them to become successful and upstanding members of their community and church.

After earning a degree in civil engineering from UC, Paul worked for his father’s construction company, helping it to expand to a real estate development company. He then went on to help found Paul Hemmer Companies. In addition to running a thriving business, Paul was involved in civic, religious, and educational causes. He had leadership positions in many local organizations, including Thomas More University, University of Cincinnati, Northern Kentucky University, Chamber of Commerce, and United Way. Mary went on to nursing school and became a nurse at Saint Elizabeth Hospital. She was a Eucharistic minister, school volunteer, and a member of various prayer groups and religious organizations such as Legatus.

Paul and Mary passed on their love of education to their eight children, providing them with a Catholic grade school and high school education. All of their children are college graduates, many with advanced degrees. Wanting to share their belief in the value of education, Paul and Mary have extended their generosity to the community, contributing money and setting up scholarships to many local Catholic schools, including Saint Henry District School.

The average amount awarded annually is $1,000

A gift of stock is not only a great way to support SHDHS, but it may also provide you with increased tax savings (the tax aspects of charitable giving can be complex, so it’s a good idea to consult a tax professional about your personal giving strategy).

A gift of stock to SHDHS can be electronically delivered to:

IMPORTANT: To ensure that all donations are credited to SHDHS as quickly as possible, donors (or their brokers/agents) are asked to send written notification to the Diocese of Covington, Attn: Dale Henson, 1125 Madison Ave., Covington, KY 41011, dhenson@covdio.org. The notice should include the following:

Requirements: Must be a student-athlete at SHDHS

Grades: 9, 10, 11

The Dan Shea Memorial Scholarship was established in memory of Dan Shea and will be awarded annually to a current SHDHS student-athlete. Dan was a devoted family man with a big heart who felt the need to give to others. Dan had a passion for sports. He coached youth baseball, high school baseball, and golf at SHDHS. He loved watching his children play sports at SHDHS, with his sons competing in baseball and basketball while his daughters participated in volleyball, basketball, and track. Mr Shea was also well known amongst students as SHDHS’s favorite substitute teacher.

The average amount awarded annually is $1,000

Grades: 8,9,10, 11

This scholarship was established by Wayne and Sylvia Hartke, class of ‘57, to promote the value of Catholic education and honor the life-long friendships they made in high school. The Hartke family has strong ties to the community (Lee Hartke Auto Body est. 1945 and Wayne Hartke with 5 Serv Pro Franchises in Northern KY). Many family members attended SHDHS. Students are selected based on financial needs and academic effort.

The average amount awarded annually is $1,000

Requirements: Essay, Resume

Grades: 8, 9, 10, 11

This scholarship was established in memory of Nick Wilde, Class of ‘10. This award assists a student at SHDHS who has a real passion for something, whether it be a club, sport, service, academics, or other activity, is a focused competitor, and has a financial need to attend SHDHS. Recipients can be incoming freshmen through current juniors and will be selected with the assistance of the Wilde family and the SHDHS men’s soccer coaching staff.

The average amount awarded annually is $1,000

Requirements: Essay

Grade: 8

This scholarship was established in memory of Beth Wendling, Class of 2008, who died on January 12, 2005 during her freshman year from complications following surgery. This financial aid award is based on financial need and other criteria such as community service and faith leadership.

The average amount awarded annually is $1,000

Requirements: Essay

Grades: 9, 10, 11

This scholarship was established in memory of Bill Tobergte by his children and is awarded bi-annually to a current SHDHS freshman, sophomore, or junior. The award is given based on a student’s written essay, Christian behavior, extracurricular participation, and grade point average.

The average amount awarded bi-annually is $1,000

Grades: 9, 10, 11

This scholarship was established by Mr. and Mrs. Richard ’57 and Mary Kay and the Schmeing family in honor of their parents, Mr. and Mrs. Walter and Louise Schmeing. It is given each year to a qualifying student who maintains above-average grades.

The average amount awarded annually is $1,000

Grades: 9, 10, 11

This scholarship was established by Mr. and Mrs. Rouse to promote the value of Catholic education and honor the life-long friendships they made while in high school. Students are selected based on financial need and academic effort.

The average amount awarded annually is $1,000 to five (5) recipients (total of $5,000)

Grades: 8, 9, 10, 11

This scholarship was established in memory of Jim Paul ’75, by his wife, Patricia, and brother, Terry. Jim was killed in the terrorist attacks on the World Trade Center Towers in New York City on the 9/11/01. It is awarded to a student from Elsmere, where Jim grew up. The award is given based on financial need.

The average amount awarded annually is $1,000

Grades: 8, 9, 10, 11

This scholarship. The award may either be given to a student who is currently enrolled in a Study Skills course (contingent upon financial need) or used to enhance the Study Skills program further.

The average amount awarded annually is $1,000

Requirements: Essay

Grade: 11

This scholarship was established by family members of June Kohorst Kroger, a 1943 graduate of St. Henry, to honor Mrs. Kroger’s love of all things St. Henry. Current juniors are invited to apply for this scholarship and must submit an essay describing how they, like Mrs. Kroger, have worked to exemplify our five pillars of success during their years at SHDHS.

The average amount awarded annually is $1,000

This endowed scholarship was established by Mr. and Mrs. John and Joyce (Ruehl) ’51 Berning in 2006 to protect the future of Catholic education and assist the SHDHS families.

The average amount awarded annually is $1,000